President Donald Trump has audaciously claimed virtually unlimited power to bypass Congress and impose sweeping taxes on foreign products.

Now a federal appeals court has thrown a roadblock in his path.

The U.S. Court of Appeals for the Federal Circuit ruled on Aug. 29 that Trump went too far when he declared national emergencies to justify imposing sweeping import taxes on almost every country on earth. The appeals court decision tossed out a part of that ruling striking down the tariffs immediately, allowing his administration time to appeal to the U.S. Supreme Court.

The ruling was a big setback for Trump, whose erratic trade policies have rocked financial markets, paralyzed businesses with uncertainty and raised fears of higher prices and slower economic growth.

The court’s decision centers on the tariffs Trump slapped in April on almost all U.S. trading partners and levies he imposed before that on China, Mexico and Canada .

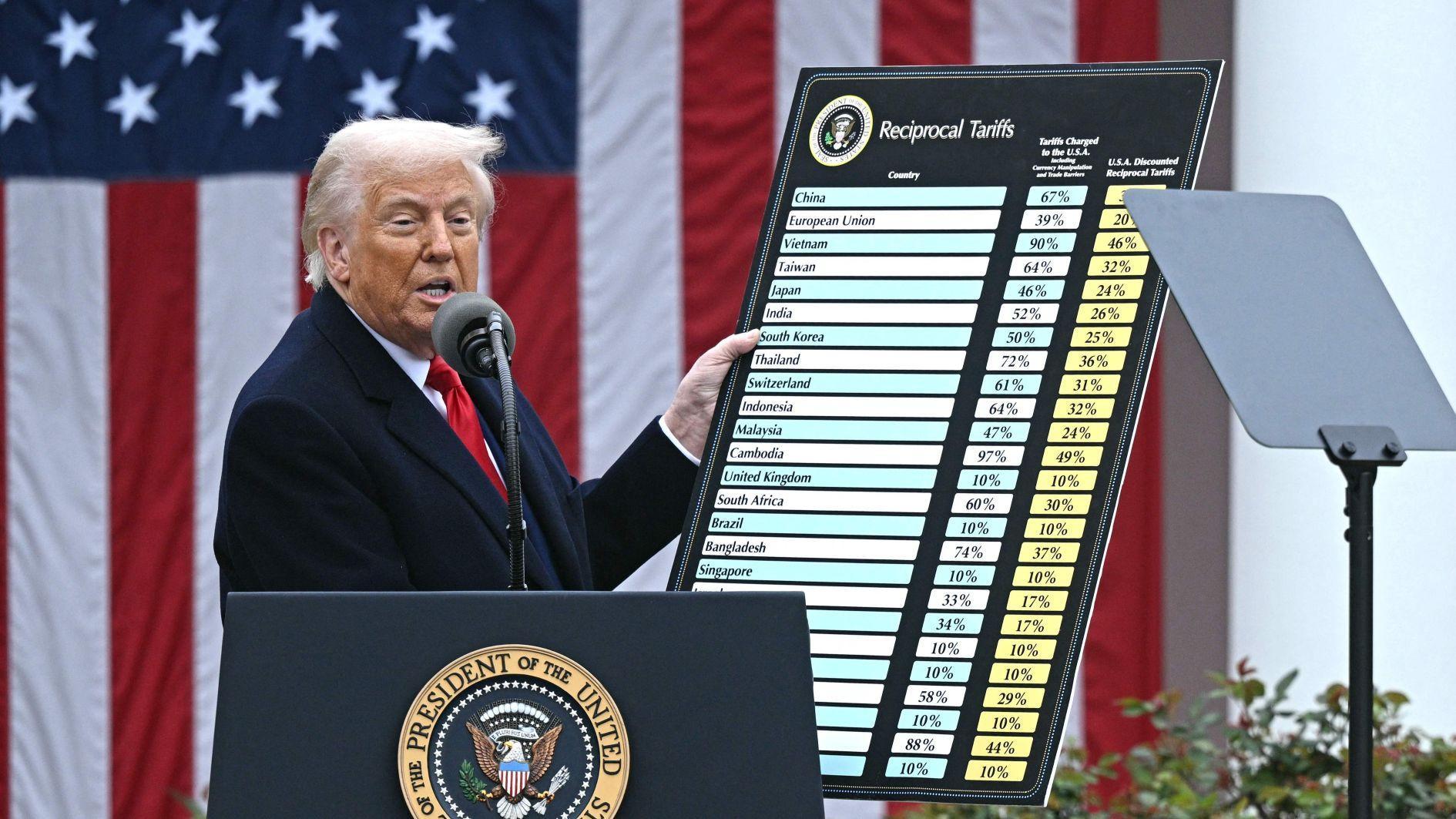

Trump on April 2 — Liberation Day, he called it — imposed so-called reciprocal tariffs of up to 50 percent on countries with which the United States runs a trade deficit and 10 percent baseline tariffs on almost everybody else.

The president later suspended the reciprocal tariffs for 90 days to give countries time to negotiate trade agreements with the United States — and reduce their barriers to American exports. Some of them did — including the United Kingdom, Japan and the European Union — and agreed to lopsided deals with Trump to avoid even bigger tariffs.

Those that didn't knuckle under — or otherwise incurred Trump's wrath — got hit harder earlier this month.

Claiming extraordinary power to act without congressional approval, Trump justified the taxes under the 1977 International Emergency Economic Powers Act by declaring the United States' longstanding trade deficits “a national emergency.”

The U.S. Constitution gives Congress the power to set taxes, including tariffs. But lawmakers have gradually let presidents assume more power over tariffs — and Trump has made the most of it.

The court challenge does not cover other Trump tariffs, including levies on foreign steel, aluminum and autos.

Nor does it include tariffs that Trump imposed on China in his first term.

The government has argued that if Trump's tariffs are struck down, it might have to refund some of the import taxes that it’s collected, delivering a financial blow to the U.S. Treasury. Revenue from tariffs totaled $159 billion by July, more than double what it was at the same point the year before. Indeed, the Justice Department warned in a legal filing this month that revoking the tariffs could mean “financial ruin” for the United States.

The president vowed to take the fight to the Supreme Court. “If allowed to stand, this Decision would literally destroy the United States of America,” he wrote on his social media platform.

Trump does have alternative laws for imposing import taxes, but they would limit the speed and severity with which he could act. For instance, in its decision in May, the trade court noted that Trump retains more limited power to impose tariffs to address trade deficits under another statute, the Trade Act of 1974. But that law restricts tariffs to 15 percent and to just 150 days on countries with which the United States runs big trade deficits.

The administration could also invoke levies under a different legal authority — Section 232 of the Trade Expansion Act of 1962 — as it did with tariffs on foreign steel, aluminum and autos. But that requires a Commerce Department investigation and cannot simply be imposed at the president’s own discretion.